Enhancing Your Mobile Banking Experience with ABBYY's Mobile OCR Technology

Enhancing Your Mobile Banking Experience with ABBYY’s Mobile OCR Technology

Mobile Capture for Mobile Banking

April 19, 2016

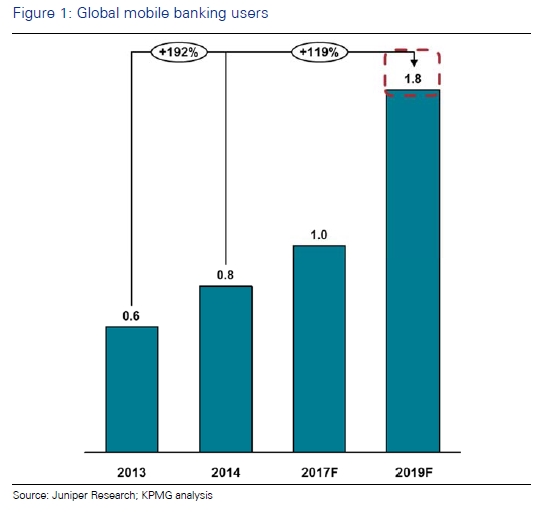

According to KPMG , mobile is already the largest banking channel for the majority of banks by volume of transactions, and the number of mobile banking app users looks set to rise from 0.8bn in 2014 to 1.8bn by 2019.

While mobile banking apps today are a must-have for a modern bank, image/camera based features are becoming a must-have for mobile banking apps. According to the same KPMG report, about one third of leading global banks already have image-based features in their apps!

With these features:

- users log in to their bank app more often and make more billing transactions;

- these features decrease the cost of transactions (see JP Morgan case in the KPMG report).

Globally, there is a multi-fold rise in the number of banks that are planning to or have already launched image/camera based features for the mass market. What better time to talk about what ABBYY knows about using image capture in mobile banking apps!

How OCR can be used in mobile banking applications

Image/camera based features mentioned in the KPMG report include:

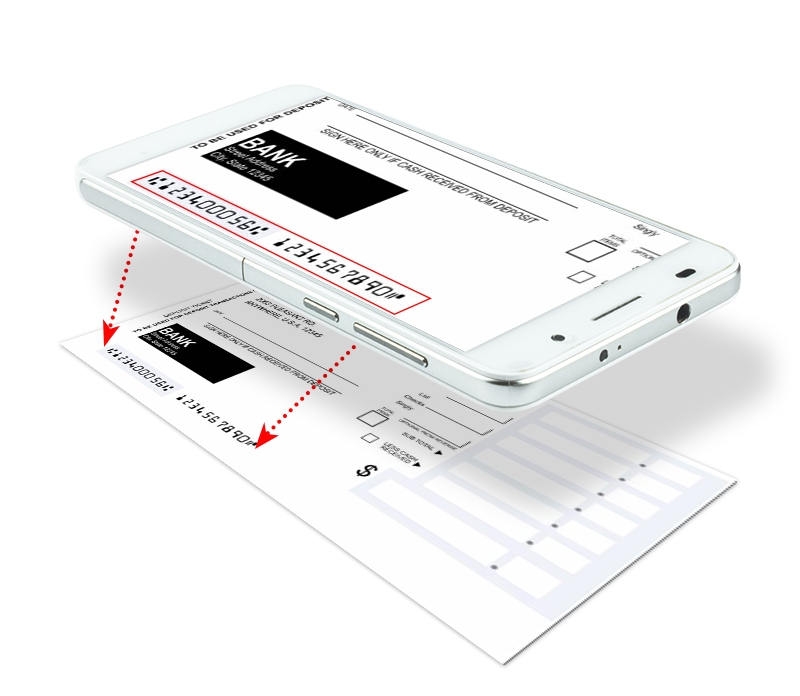

- Taking a picture of a paper check/bill to deposit or send to/from the bank.

- Binarizing the photo and saving it on the server for transaction confirmation.

- Utilizing OCR to capture the data from the image and using it for transaction automation.

OCR used in business apps should be highly-accurate, otherwise it will not decrease transaction costs or could even harm company reputation because of bad customer experience. The higher the accuracy, the better the customer experience and the higher the satisfaction. That’s why banks usually prefer to use business-level OCR, not those that are distributed for free.

OCR used in banking apps can be in a form of:

- an offline mobile OCR SDK

- Cloud-based API

- or server-based SDKs.

The last two options will provide higher accuracy on bad images, but on-device mobile OCR will allow to avoid sending an image via the Internet which is a great advantage from a security point of view.

In addition, on-device image preprocessing (for example, ABBYY Mobile Imaging SDK ) can be applied to:

- check image quality right on the device before sending it to the server (and ask the user to retake the photo if the quality is not good enough);

- compress and crop an image for faster transfer over the mobile network.

How about some real-life cases?

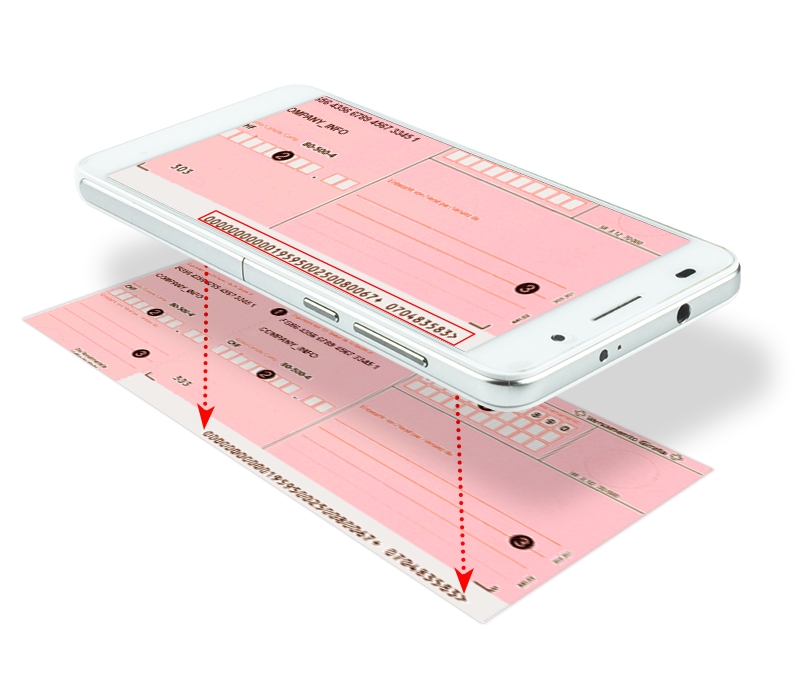

Capturing payment slip info with offline mobile OCR

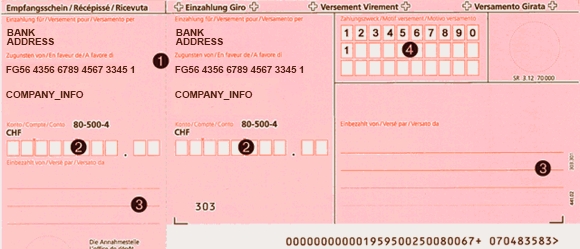

In Switzerland almost any type of payment order is accompanied with a Swiss Orange Payment Slip.

One leading European bank decided to enrich their mobile banking app, offering the chance to take a photo of such a slip and obviate manual input of payment information. Here is how it was implemented:

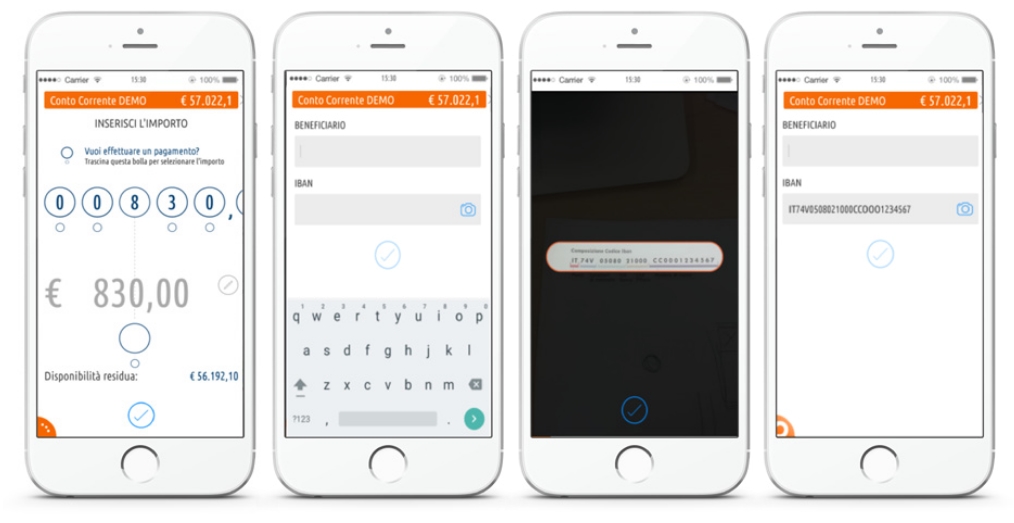

Cloud OCR used to capture IBAN

With its Mobile Banking App, Veneto Banca, one of Italy’s leading banks, offers its customers a modern way to transfer money using their smartphones. When transferring money, the international bank account number (IBAN) must be entered first to identify the recipient’s account. The IBAN is an internationally agreed system of identifying bank accounts across national borders, to facilitate the communication and processing of cross-border transactions with a reduced risk of transcription errors. As the IBAN consists of up to 34 alphanumeric characters, a single character can easily be omitted, duplicated, or two characters can be transposed. To avoid such errors, Veneto Banca introduced an innovative way to enter the IBAN: instead of typing the long string of characters manually, the customer can use their smartphone to take a photo of the relevant area of a document containing the printed IBAN information. This image is automatically sent to the integrated ABBYY Cloud OCR SDK service, which returns a string of IBAN characters to the Mobile Banking App. This way, the long IBAN string is automatically inserted into the right field without the need for error-prone manual entry.

- Enter the amount to be transferred.

- Tap the camera icon in the IBAN field to take a screenshot.

- Specify the area containing the IBAN.

- Finished: please confirm the transfer.

Source: http://www.venetobanca.it/bankup-mobile-banking/ . Image copyright: ©2015, Veneto Banca, Italy.

The cases above demonstrate how payments through the mobile banking app are made easier using mobile capture. Consider adding camera-based features to your banking app to further increase of customer satisfaction, and take a look at ABBYY OCR SDKs for implementation of such features.

Like, share or repost

Share

Subscribe for blog updates

First name*

E-mail*

Сountry*

СountryAfghanistanAland IslandsAlbaniaAlgeriaAmerican SamoaAndorraAngolaAnguillaAntarcticaAntigua and BarbudaArgentinaArmeniaArubaAustraliaAustriaAzerbaijanBahamasBahrainBangladeshBarbadosBelgiumBelizeBeninBermudaBhutanBoliviaBonaire, Sint Eustatius and SabaBosnia and HerzegovinaBotswanaBouvet IslandBrazilBritish Indian Ocean TerritoryBritish Virgin IslandsBrunei DarussalamBulgariaBurkina FasoBurundiCambodiaCameroonCanadaCape VerdeCayman IslandsCentral African RepublicChadChileChinaChristmas IslandCocos (Keeling) IslandsColombiaComorosCongo (Brazzaville)Congo, (Kinshasa)Cook IslandsCosta RicaCroatiaCuraçaoCyprusCzech RepublicCôte d’IvoireDenmarkDjiboutiDominicaDominican RepublicEcuadorEgyptEl SalvadorEquatorial GuineaEritreaEstoniaEthiopiaFalkland Islands (Malvinas)Faroe IslandsFijiFinlandFranceFrench GuianaFrench PolynesiaFrench Southern TerritoriesGabonGambiaGeorgiaGermanyGhanaGibraltarGreeceGreenlandGrenadaGuadeloupeGuamGuatemalaGuernseyGuineaGuinea-BissauGuyanaHaitiHeard and Mcdonald IslandsHoly See (Vatican City State)HondurasHong Kong, SAR ChinaHungaryIcelandIndiaIndonesiaIraqIrelandIsle of ManIsraelITJamaicaJapanJerseyJordanKazakhstanKenyaKiribatiKorea (South)KuwaitKyrgyzstanLao PDRLatviaLebanonLesothoLiberiaLibyaLiechtensteinLithuaniaLuxembourgMacao, SAR ChinaMacedonia, Republic ofMadagascarMalawiMalaysiaMaldivesMaliMaltaMarshall IslandsMartiniqueMauritaniaMauritiusMayotteMexicoMicronesia, Federated States ofMoldovaMonacoMongoliaMontenegroMontserratMoroccoMozambiqueMyanmarNamibiaNauruNepalNetherlandsNetherlands AntillesNew CaledoniaNew ZealandNicaraguaNigerNigeriaNiueNorfolk IslandNorthern Mariana IslandsNorwayOmanPakistanPalauPalestinian TerritoryPanamaPapua New GuineaParaguayPeruPhilippinesPitcairnPolandPortugalPuerto RicoQatarRomaniaRwandaRéunionSaint HelenaSaint Kitts and NevisSaint LuciaSaint Pierre and MiquelonSaint Vincent and GrenadinesSaint-BarthélemySaint-Martin (French part)SamoaSan MarinoSao Tome and PrincipeSaudi ArabiaSenegalSerbiaSeychellesSierra LeoneSingaporeSint Maarten (Dutch part)SlovakiaSloveniaSolomon IslandsSouth AfricaSouth Georgia and the South Sandwich IslandsSouth SudanSpainSri LankaSurinameSvalbard and Jan Mayen IslandsSwazilandSwedenSwitzerlandTaiwan, Republic of ChinaTajikistanTanzania, United Republic ofThailandTimor-LesteTogoTokelauTongaTrinidad and TobagoTunisiaTurkeyTurks and Caicos IslandsTuvaluUgandaUkraineUnited Arab EmiratesUnited KingdomUnited States of AmericaUruguayUS Minor Outlying IslandsUzbekistanVanuatuVenezuela (Bolivarian Republic)Viet NamVirgin Islands, USWallis and Futuna IslandsWestern SaharaZambiaZimbabwe

I have read and agree with the Privacy policy and the Cookie policy .

I agree to receive email updates from ABBYY Solutions Ltd. such as news related to ABBYY Solutions Ltd. products and technologies, invitations to events and webinars, and information about whitepapers and content related to ABBYY Solutions Ltd. products and services.

I am aware that my consent could be revoked at any time by clicking the unsubscribe link inside any email received from ABBYY Solutions Ltd. or via ABBYY Data Subject Access Rights Form .

Referrer

Last name

Query string

Product Interest Temp

UTM Campaign Name

UTM Medium

UTM Source

ITM Source

GA Client ID

UTM Content

GDPR Consent Note

Captcha Score

Page URL

Connect with us

Also read:

- [New] Tech Triumphs Cutting-Edge VR Devices Reviewed

- [Updated] Alternatives to VLC Revealed in Detailed Review for 2024

- [Updated] Rapid DIY Techniques That Every Indie Filmmaker Should Try

- [Updated] The Ultimate Guide to Blurring iPhone Pics at Zero Cost

- 2024 Approved Synthesizing a Look at MAGIX Creative Suite

- 2024 Approved Unlocking Brightness and Saturation in PS Basics

- Conversion Online Di File MOV a MP3 Con Gratuita - Utilizzo Effettivo Dei Servizi Movavi

- Counteracting the Impact of VAC Denial in Steam Gaming

- Eliminate Lag & Freeze in Win11

- Get Your Canon MX49n Printer Up-to-Date with New Windows Drivers Here

- How to Access Your Apple iPhone 13 Pro Max When You Forget the Passcode? | Dr.fone

- Read This Guide to Find a Reliable Alternative to Fake GPS On Xiaomi 14 Pro | Dr.fone

- The Art and Science of Hand Movement Tracking for 2024

- The Pathway to Viral Fame Mastering Instagram with These 9 Essential Strategies for 2024

- WhatsApp on Mac: A Comprehensive Walkthrough for Beginners

- Title: Enhancing Your Mobile Banking Experience with ABBYY's Mobile OCR Technology

- Author: Christopher

- Created at : 2025-01-15 02:33:20

- Updated at : 2025-01-21 17:54:21

- Link: https://some-approaches.techidaily.com/enhancing-your-mobile-banking-experience-with-abbyys-mobile-ocr-technology/

- License: This work is licensed under CC BY-NC-SA 4.0.